There Is No Such Thing As A Free Lunch

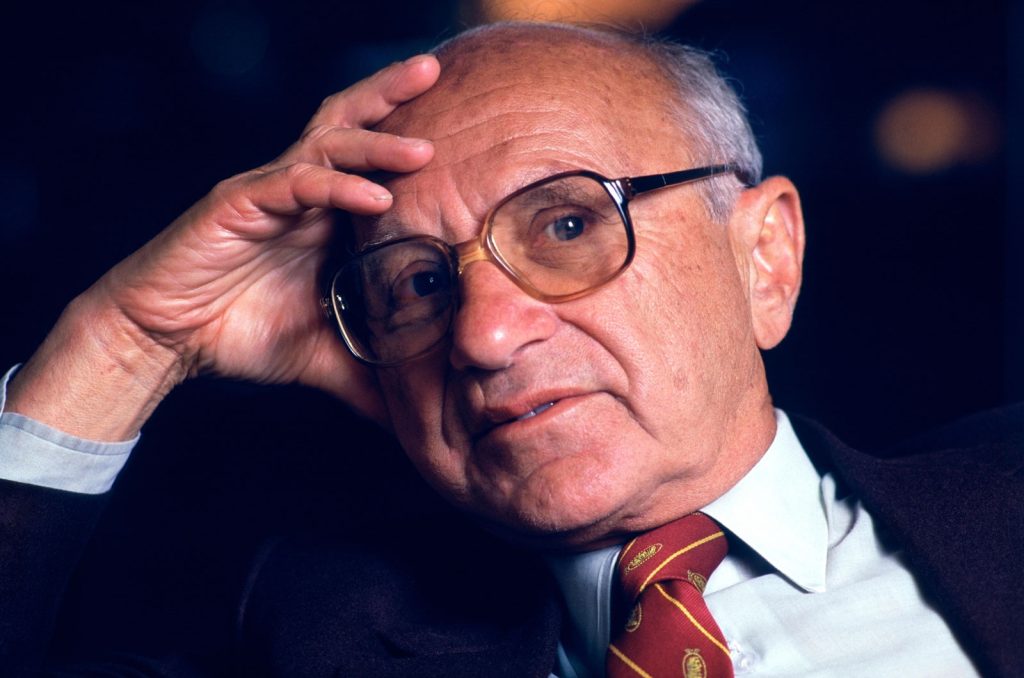

Although commonly attributed to Nobel Laureate Milton Friedman, the expression “There ain’t no such thing as a free lunch” long predated him.

In fact, it described the practice of saloons (bars) offering a “free” lunch to patrons who purchased at least one drink. The luncheon was generally high in salt (cheese, salted crackers, nuts), enticing patrons to purchase generous volumes of high-priced beer. If you weren’t paying attention, and fell for the trap, you wound up paying much more for the “free lunch”. The exploitation of a cognitive bias leads to over consumption (eg cheap and poor quality food) and over payment (eg through purchase of excess beer).

Which brings us to Australia – the land of the free and home of the expensive. Not free as in freedom, but free as in government delivered services including healthcare and education that are perceived to be free. And as with the salty food, there is over consumption and excessive cost. Like the free lunch, Australians do not get free healthcare or education. Every single one of us pays; just in a different way.

Healthcare is funded through the Medicare levy and general taxes at the State and Commonwealth level, including income tax and GST. So, whether you are a billionaire or on welfare, you are paying taxes that fund healthcare. And because healthcare is presented as “free”, there is inevitable overconsumption and waste.

Referencing Milton Friedman again, he observed that there are essentially four ways to spend money:

- You can spend your own money on yourself.

- You can spend your own money on someone else.

- You can spend somebody else’s money on yourself.

- You can spend somebody else’s money on somebody else.

When you spend your own money on yourself, you are very careful because you are looking for value. You won’t be as careful when you spend your own money on someone else, but you will look for value.

When you spend somebody else’s money on yourself, you are more interested in making your life comfortable than achieving value, but you will at least expect to gain a benefit.

Healthcare falls into the fourth category, of spending other people’s money on somebody else. There is no incentive to pursue value at all.

While we pretend healthcare is free, in reality it is bureaucrats in offices spending other people’s money on others. That includes finding new ways to expand their domain.

Consider the Commonwealth Department of Health and Aged Care. According to its 2021-22 annual report, at 30 June 2022

- It employed 5,154 persons – up from 4,450 the year prior,

- These staff cost $697 million – up from $559 million the year prior, and

- Its operating expenses were $1.3 billion – up from $1.1 billion the year prior.

All this and yet the department did not operate a single hospital or aged care facility.

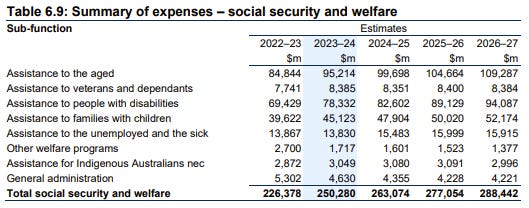

According to the Australian Institute of Health and Welfare (a government body), in 2020-21, total health spending in Australia was over $220 billion of which over 70% was government (Commonwealth, State, and Territory). That does not sound very free.

A government commissioned review also found that perhaps 10% of the Medicare program was subject to waste and fraud. Why? Perhaps because governments are spending somebody else’s money on somebody else.

This is not to suggest that there would be no government health expenditure if this charade of free healthcare was ended. It might however lead to a much more responsive and cost-efficient system. Consider how much lower taxes could be, or how much higher pensions might be, but for the inefficiency and waste of Australia’s “free” healthcare system.

We are told by Professor Duncan Maskell, the Vice-Chancellor (CEO) of the University of Melbourne, that “one of the most important radical changes that could be made to facilitate this would be once more to make education free to the Australian domestic student”. Australia already has an over-production problem of university graduates, and Maskell’s proposal would make it even worse. Why? Because universities would be spending somebody else’s money on somebody else.

To make university education “free to the Australian domestic student” would require someone else to pay for it, including those who do not and will never attend university. It wouldn’t be free; it would just be paid for by someone else.

If Professor Maskell, who is reported to be on an annual salary package of $1.5 million, really wants to make university cheaper and/or free for students, he should first look in his back yard. According to the Melbourne University annual report, in 2022 it had approximately 53,000 students and employee related expenses of $1.6 billion. That’s approximately $31,000 per student. It would certainly make the cost of education much lower if Professor Maskell and all his staff worked for free.