Philosophy #1: Living On Other People’s Money Is Unwise

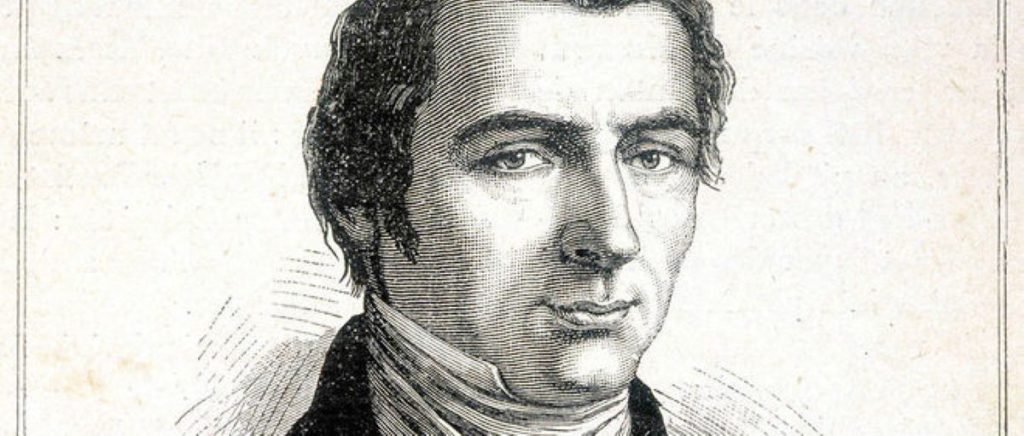

When reading the news and opinion, I am frequently mindful of the idea of other people’s money and the perceptive words of French economist Frederic Bastiat, who wrote that “The state is the great fictitious entity by which everyone seeks to live at the expense of everyone else.”

I thought of Bastiat when reading a recent opinion column by Ross Gittins, the Economics Editor of the Sydney Morning Herald. There really needs to be a better lexigraphy to reflect the differences between the economic writings of Bastiat and Gittins. After all, we don’t call plumbers aquatic surgeons.

Philosophy #2: Exploiting Other People’s Money Is Good

In Gittins’ latest, he again advocates for higher taxes, because “… paying tax is good and, for better government, we should pay more”. Evidence be damned, that ever more expensive government has delivered ever worse outcomes – from education, to health, to defence. But for some, it is axiomatic that we must tax other people’s money more.

Messrs Gittins and Keating: you are welcome to voluntarily pay higher tax. But until you do, please don’t demand that others are forcibly required to do so.

As long as it is other people’s taxes. The funny thing is that those who advocate higher taxes never seem to volunteer to pay higher taxes themselves. No doubt, the ATO would accept voluntary contributions, but that is not the game. Higher tax advocates don’t want to pay higher taxes themselves. They just want other people’s money so that they can “live at the expense of everyone else” as Bastiat predicted.

Call To Authority

Gittins starts his case with a call to authority saying that “former top econocrat did something no serving econocrat is allowed to do, and no politician is game to do: he set out the case for us to pay higher, not lower, taxes.” That former econocrat is Michael Keating (unrelated to Paul Keating) and he delivered his remarks at the Australia Institute’s revenue summit at Parliament House in Canberra. That’s the Australia Institute that has never found a tax or regulation they did not like.

Keating and Gittins are reflecting what is known as bureaucrat logic: that increasing input delivers better outcomes.

Permit some definitions:

- Inputs are resources going in – such as dollars.

- Outputs are things that are produced with the inputs – such as patients treated or students graduated.

- Outcomes are the results – such as healthy citizens and kids who can read.

But for some, it is axiomatic that taxes must be increased.

No Linear Relationship Between Inputs and Outcomes

Bureaucrats, econocrats and many politicians seem to believe that, despite evidence upon evidence to the contrary, there is a linear relationship between inputs and outcomes. Increase education spending and you get more literate kids. Huge increases in Gonski funding delivering worse education outcomes is just a bump in the road. Even more is required.

Messrs Gittins and Keating: you are welcome to voluntarily pay higher tax. But until you do, please don’t demand that others are forcibly required to do so.

As American writer Harlan Ellison said: “The two most common elements in the universe are hydrogen and stupidity.” There seems to be a high concentration of both in Canberra.

I set before you the state of educational decline in Australia which is inversely linked to government expenditure on the sector. I could also mention the spectacular amount of money spent on indigenous affairs and the woeful outcomes, however, this would also require me to mention NDIS (golly gosh I would never have guessed that that would become a sinkhole for cash)!

Those who advocate for big government and big spending need to demonstrate where value has been already delivered, a requirement which is generally regarded as near impossible as government spending, incompetence and waste are inextricably linked.

I am reminded that there are three types of money. Mine, which of course is very important. Your’s which I am concerned about, and their’s which doesn’t matter in the slightest. And unfortunately, governments only spend the latter.