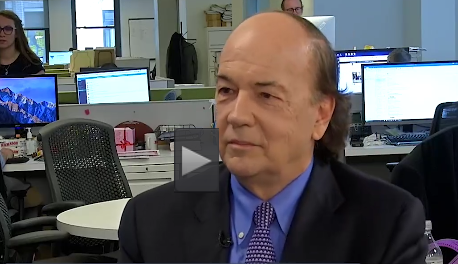

Jim Rickards, an esteemed American investment banker and author with expertise in finance and precious metals, recently brought to light an intriguing prediction regarding the BRICS+ countries:

“I recently revealed that the so-called “BRICS+” countries will announce the creation of a new currency at its annual leaders’ summit conference on August 22–24. This will be the biggest upheaval in international finance since 1971 … the world is unprepared for this geopolitical shock wave. It appears likely that the new BRICS+ currency will be linked to a weight of gold. This plays to the strengths of BRICS+ members Russia and China. These countries are the two largest gold producers in the world, and are ranked sixth and seventh respectively among the 100 nations with gold reserves.”

Understanding BRICS+

BRICS+ is a group of states consisting of Brazil, Russia, India, China, and South Africa. “BRIC” was coined in 2001 for fast-growing, potentially dominant forces in the global economy by 2050. South Africa’s later inclusion expanded it to BRICS+.

Over 17 years, BRICS+ has endeavoured to become a counterbalance to western hegemony. Its institutions like the New Development Bank (NDB) and Contingent Reserve Arrangement are alternatives to the World Bank and the IMF.

This alliance boasts:

- Combined economic influence and abundant resources

- Seven countries in the membership queue, with 13-14 awaiting consideration

Come August, Saudi Arabia’s inclusion will mark:

- 50% of the global population within BRICS+

- 30% of global landmass

- 54% of global GDP

- Two top oil producers: Russia and Saudi Arabia

- 15%-20% of global gold reserves.

Moreover, an amalgamation involving the Eurasian Economic Union and Shanghai Cooperation Organisation seems on the horizon.

After their first formal meeting in 2009, BRICS+ asserted the necessity for “a stable, predictable, and diversified international monetary system.” Rickards postulates that BRICS+ is gearing up to unveil its currency.

BRICS+ Currency

Recently, Rickards gave a fascinating interview on the YouTube channel Wealthion. In this interview, he was adamant that the BRICS+ currency, (which he termed a BRIC, for convenience), “is not a gold standard”.

“The value of the BRIC is not determined with reference to any other currency. It is determined with reference to gold, by weight of gold”.

The implication of the BRICS+ currency being tied to a weight of gold means that, regardless of anything else going on financially and economically in the world:

1 unit of BRICS+ currency = specified weight in gold

Trade between 50% of the world’s population will transition to BRICS+ currency, which will be defined in gold, so half the world’s trade will be transacted in BRICS+ currency.

Gold’s Unwavering Stature

Warren Buffet, an investment giant, once opined on gold: “Gold…has two significant shortcomings, being neither of much use nor procreative.”

Despite Buffet’s scepticism, gold’s reputation as a store of value has persisted for 5,000 years. He is missing the point of gold. Gold is not an investment, it is real money, unlike the 600 odd fiat currencies in the history of the world that have gone to zero.

Gold fulfills money’s 6 characteristics:

- Durability

- Portability

- Divisibility

- Uniformity

- Limited Supply

- Acceptability.

BRICS+’ gold linkage suggests, in the medium to long term, a potential for spikes in gold demand and the nominal currency price of gold.

A Waning USD?

Let’s take a look at the world’s current world currency, the U.S. dollar. The USD does not fulfill the attributes of money.

The U.S. dollar’s decline is palpable. In 1913, when the US Federal Reserve was established, the fixed price of gold was US$20.67. President Nixon infamously broke the gold peg that was US$35 in 1971. Today, gold hovers around $1,914 per ounce. The dollar’s worth is now 1.8% of what it was in 1971, a staggering 98% fall over 52 years.

Rickards’ analysis paints a bleak dollar future, in contrast to the BRICS+: “This is a bet that the dollar is going to collapse against you over time. I think that’s a very good bet … this is not a three-month forecast … you want to launch this new currency and you say hey long term the dollar is going to collapse in terms of gold. I’ll hook my horse to this wagon called gold by weight, and I’ll just reap the benefits.”

Libertarian Lens

The essential question for libertarians is “What can we do, so that we and our families survive and thrive?”

As Murray Rothbard insightfully shared, “I see a great future for gold and silver coins as the currency people may increasingly turn to when paper currencies begin to disintegrate.”

Allowing for one year’s living costs in cash, keep spare gold in hand (not as ETFs or in banks, which carry counterparty risks). Then, you have a store of value that has well and truly proven itself over millennia.

Gold never takes its promises lightly.

What preconditions would need to exist for the USD to return to the gold standard? Are those preconditions realistic? Wondering aloud here …