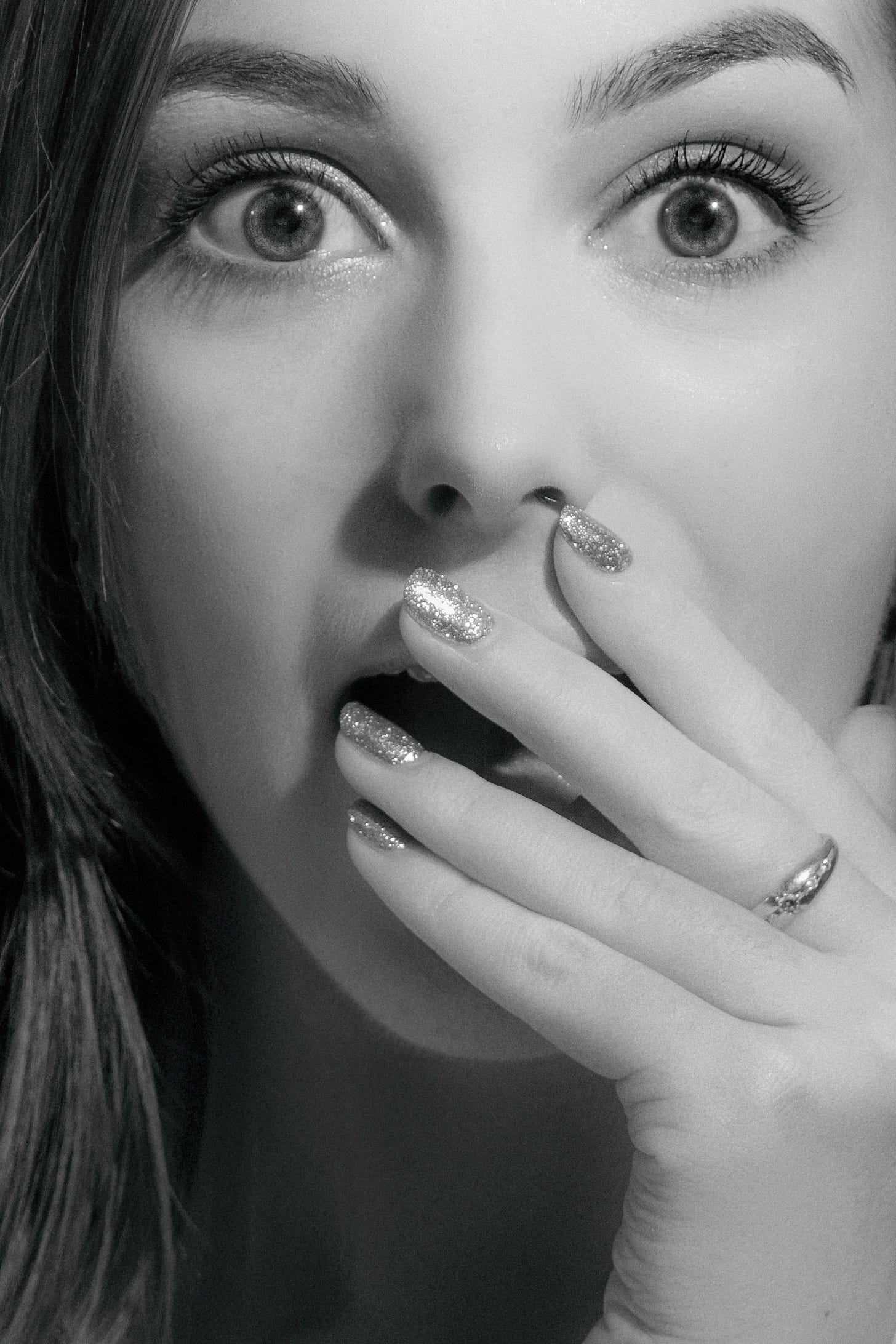

Have you ever wondered how many taxes there are in Australia?

The answer might shock you!

Here’s the list. (If I’ve missed some, please let me know in the comments below):

- (Federal) Personal Income Tax (aka PAYG Withholding Taxes)

- (Federal) Company Tax

- (Federal) Capital Gains Tax

- (Federal) Goods and Services Tax

- (Federal) Fringe Benefits Tax

- (Federal) Medicare Levy

- (Federal) Medicare Levy Surcharge

- (Federal) Superannuation Guarantee

- (Federal) Superannuation Guarantee Charge

- (Federal) Luxury Car Tax

- (Federal) Customs Duty

- (State) Payroll Tax

- (State) Land Tax

- (State) Stamp Duty on Transfer of Real Estate

- (State) Stamp Duty on Motor Vehicle Registration

- (State) Stamp Duty on Motor Vehicle Transfer

- (State) Stamp Duty on Insurance Policies

- (State) Stamp Duty on Leases

- (State) Stamp Duty on Mortgages

- (State) Stamp Duty on Hire Purchase Agreements

- (State) Stamp Duty on Transfer of Business

- (State) Stamp Duty on Transfer of Shares

- (State) Excise Duty on Fuel

- (State) Excise Duty on Alcohol

- (State) Excise Duty on Tobacco

- (Local) Council Rates

To my count, that is twenty-six different taxes.

What have I missed?

Great work! According to my estimates 1 in 3 Australians are employed in the public sector. Roughly 30% of GDP paid taxes.

Australia is sleep walking into a socialist state! We are have also invented negative development where if we continue on this trend we will have insufficient savings to fund any investment whatsoever: all spent on government consumption! Time to reread Hayek. Your list does not include hidden taxes such as building permits etc